Table of Contents

- – SoftBank to acquire ABB’s robotics division for $5.375B — a strategic shift from spin‑off to outright sale

- – FABTECH 2025: show floor highlights migration to automated, sensor‑driven and hybrid welding workflows

- – ESAB ships factory‑matched 500 A push‑pull MIG system for high‑amp robotic work

- – BLM’s ProBend HBS II adds real‑time robot/press‑brake synchronization for mixed‑part bending

- – Energy Robotics raises $13.5M Series A to scale AI‑driven autonomous inspections

This week’s headlines center on two clear themes: consolidation at the supplier level and faster adoption

of integrated, data-driven automation across welding and metal fabrication. A major M&A move

reshapes ownership of a top robot supplier, while trade-show reveals and new product launches underline

that customers want turnkey, synchronized hardware plus software and AI for inspection and process

control.

SoftBank to acquire ABB’s robotics division for $5.375B — a strategic shift from spin‑off to outright sale

Summary: ABB agreed to divest its robotics division to SoftBank Group for an enterprise

value of $5.375 billion (reported as $5.4B), abandoning the previously planned spin‑off. The transaction

covers ABB’s industrial robots, controllers and automation software business and remains subject to

regulatory approvals and customary closing conditions, with close expected in a mid‑to‑late timeframe.

Why it matters: Ownership transfer of a major robot supplier can change R&D

priorities, product roadmaps, and service/support models that fabricators, integrators and OEMs rely on;

channel partners should prepare for short‑to‑medium‑term uncertainty on warranties, roadmaps and

contractual terms while competitors respond.

Source: Robotics

and Automation News

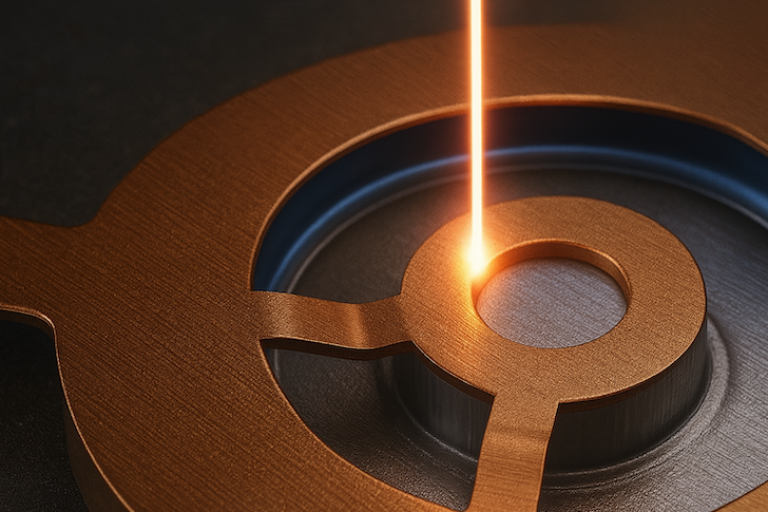

FABTECH 2025: show floor highlights migration to automated, sensor‑driven and hybrid welding workflows

Summary: FABTECH 2025 in Chicago showcased next‑generation welding and fabrication

technologies emphasizing greater automation, integrated sensing, data connectivity and hybrid/additive

processes. Exhibitors demonstrated turnkey robotic welding cells, collaborative robots for small‑part

work and software tools focused on process control and traceability.

Why it matters: The trends accelerate the shift from manual to data‑driven welding

operations—addressing skilled‑labor shortages while enabling higher throughput, repeatability and remote

optimization—pushing integrators and shops to invest in interoperable, digital workflows.

Source: The

Fabricator

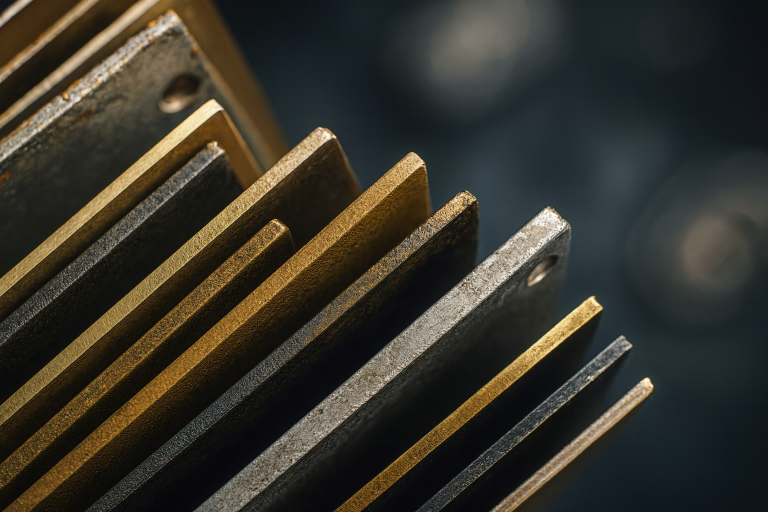

ESAB ships factory‑matched 500 A push‑pull MIG system for high‑amp robotic work

Summary: ESAB introduced a heavy industrial push‑pull MIG package pairing the Warrior

Edge 500 DX (500 A) power source with the RobustFeed Edge DX wire feeder and the new ESAB PP 350w

water‑cooled push‑pull MIG gun. The bundled system targets demanding, high‑amp push‑pull applications

where coordinated power, feeder and gun performance is critical.

Why it matters: A matched power‑source/feeder/gun package reduces integration risk and

shortens deployment time for high‑amperage robotic welding cells, making it easier for OEMs, integrators

and high‑volume fabricators to specify turnkey solutions.

Source: The

Fabricator

BLM’s

ProBend HBS II adds real‑time robot/press‑brake synchronization for mixed‑part bending

Summary: BLM GROUP USA launched the ProBend HBS II, a customizable robotic bending cell

that provides real‑time synchronization between the robot and the press brake and is configurable to

handle mixed part runs regardless of part size. The system is now available in the U.S. market.

Why it matters: Tight, real‑time coordination between robot motion and brake sequencing

reduces cycle variability and the typical friction points in automated bending cells, enabling higher

throughput and more viable lights‑out or mixed‑batch production strategies for job shops and contract

manufacturers.

Source: The

Fabricator

Energy Robotics

raises $13.5M Series A to scale AI‑driven autonomous inspections

Summary: Energy Robotics closed a $13.5 million Series A to scale its AI inspection

platform for autonomous robots and drones; the company reports completing more than 1,000,000

inspections across five continents and saving over 32,000 hours of hazardous human labor for customers

in oil & gas, industrial, chemical and utilities sectors.

Why it matters: Inspection automation is moving from pilot to scale—reducing human

exposure, increasing inspection cadence and producing data that can feed predictive‑maintenance and

pre/post‑weld repair workflows; expect faster uptake of autonomous inspection services and pressure to

integrate inspection AI with welding and maintenance toolchains.

Source: Robotics

and Automation News

Conclusion

The week underscores a clear industry direction: consolidation among major suppliers and rapid adoption

of integrated, software‑enabled automation across welding and fabrication. Practically, expect more

bundled hardware/software offers, rising demand for real‑time synchronization and inspection‑to‑repair

data flows, and short‑term vendor uncertainty where ownership changes occur. Technical teams should

prioritize open interfaces and data integration now to protect process continuity as ownership and

product roadmaps evolve.